The performance dispersion across stocks and sectors offers the opportunity to deliver superior returns. The key is to have the tools to assess the trade flows from buyers and sellers and to be able to discriminate the positive vs. negative trends on the basis of the actual price behavior.

Introducing this approach as a new paradigm for sector rotation investing and portfolio risk control, there was the need for creating the element of “trend risk control.” Our solution enables the analysis of the “trends allocation risk” for stocks and portfolios. The larger the portfolio exposure to falling stocks, the bigger is the risk of losses. This becomes a pragmatic, factual, and logical methodology to see sector rotation and portfolio risks from another perspective, as the performance of a strategy is directly linked to the trends of the holdings.

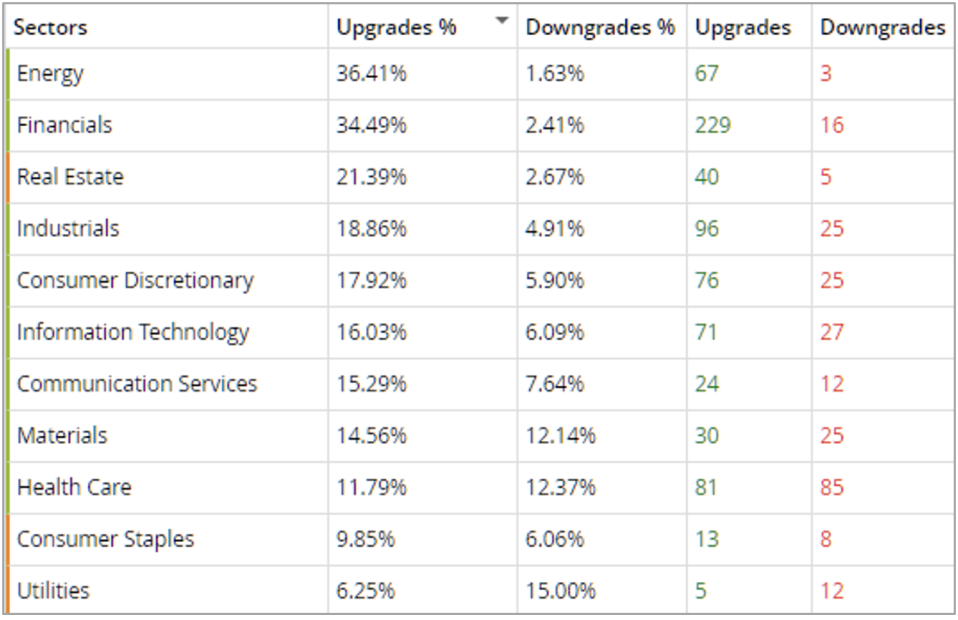

Our trend discovery model is built to assess the true direction of price trends and to capture trend reversals using a multi-factor rating methodology. In essence, an A and B rating confirms a bull trend, while a C and D rating marks a bear trend. A rating upgrade signals a positive trend reversal and a downgrade alerts about a new negative trend.

By observing in any sector, the evolution of the percentage of stocks rated A/B vs. C/D, one can spot the beginning of a change in investors’ money flow in or out of the sector. This metric can prove to be a leading indicator, capturing new trends well ahead of other metrics.

Here is a table showing for several sectors the percentage of upgrades vs. downgrades over the last four weeks.

The energy, financial and real estate sectors show a high percentage of new upgrades. More than 20% of the stocks in those sectors seem to be turning around, a sign of new interest from the investor community. That signals an increasing positive inflow. We observe the opposite in utilities where the downgrades exceed the upgrades.

In the new market cycle, we can expect more frequent sector rotation and a more extreme performance dispersion. The new market cycle is also exposing the limits of conventional data and tools. Negative trends are more frequent and extreme. Effective risk control requires smarter analytics and technology supporting a fast reaction to events.

It is therefore advisable to use any available methodology and tool that can react fast in capturing reversals and provide an edge in navigating the ups and downs of the new regime.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.